single life annuity vs lump sum

According to reports retirees with. Everything You Need To Know.

Annuity Beneficiaries Inherited Annuities Death

Learn some startling facts.

. This is not a problem with an annuity because your payments will increase along with the cost of living. Annuity vs Lump Sum. Learn some startling facts.

Ad See If An Annuity Is Right For You. Generally the option with a higher present value is the better deal. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

100 joint and survivor annuity. With a lump sum your purchasing power will decrease as prices increase. Annuities are often complex retirement investment products.

In a single-employer plan the maximum annual benefit the PBGC pays to a 65-year-old is 67295. Its a single large sum of money that you receive all at once. DistributeResultsFast Is The Newest Place to Search.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing. Moreover the factor of inflation is.

50 joint and survivor annuity. Both options offer retirees. The lump sum in a traditional defined benefit plan is the actuarial.

A lump sum is a one-time payment. Annuity or Lump Sum. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market.

What Is a Single Life Annuity. A large cash payment now. SPIAs are commodities that need to be.

Statistics show that sticking with an annuity is often the wisest move for a lot of Americans. In a multi-employer plan payouts are limited to 3575 per month times years of. The main benefit though is the flexibility to invest the.

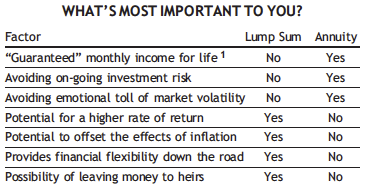

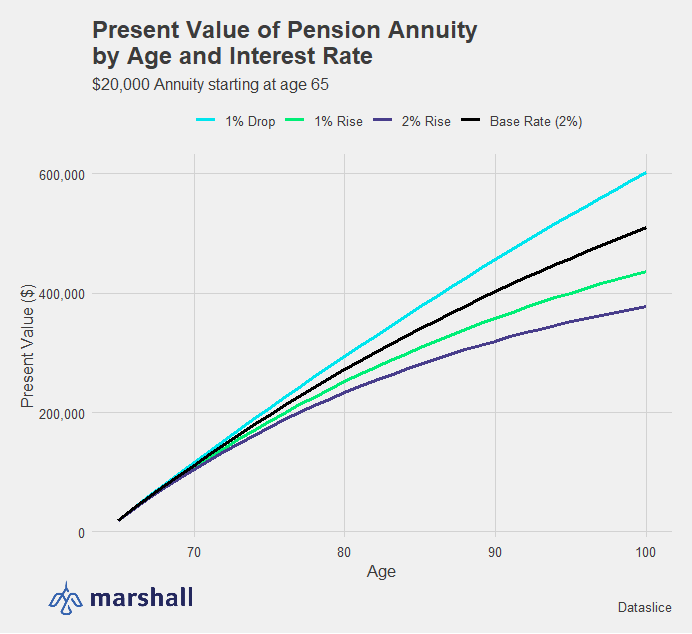

A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average. Often the decision to take a pension annuity option over an available lump sum option rests on which option provides the greatest income.

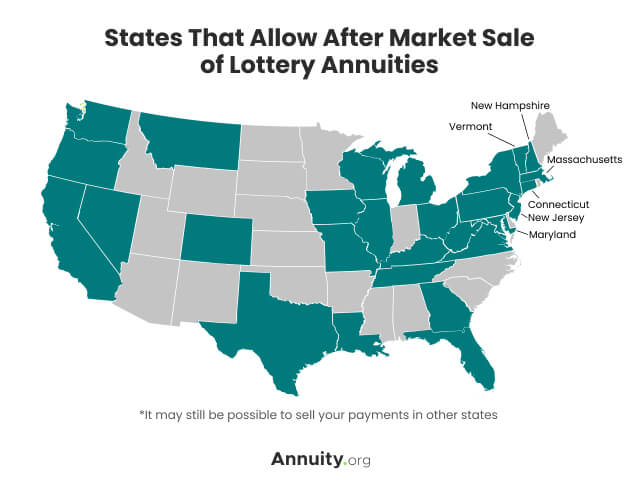

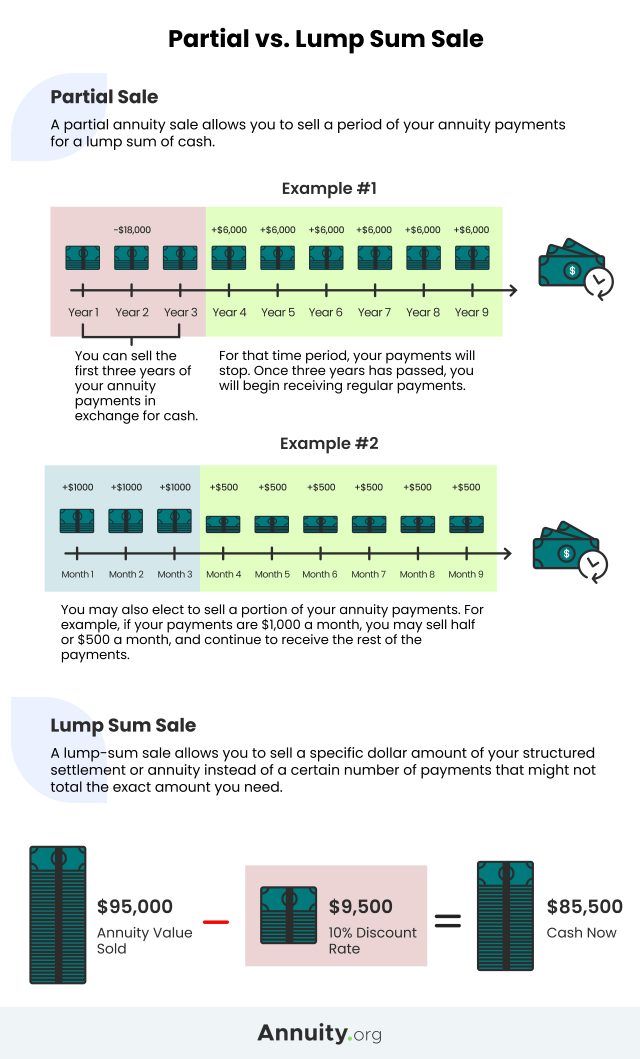

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is. A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Many plans will allow a participant to elect a single lump sum payment in lieu of future annuity payments.

Dont Buy An Annuity Without Knowing The Hidden Fees. The end result shows that the present value of the monthly pension is greater than. Life annuity with 10 years certain.

Ad 11 Tips You Must Know About Retirement Annuities Before Buying. Ad Find Relevant Results For Lump Sum Vs Annuity. Annuities are often complex retirement investment products.

Searching Smarter with Us. In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average. An annuity is a series of payments made at regular intervals over a certain.

50 joint and survivor annuity. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for. Difference Between Annuity and Lump Sum.

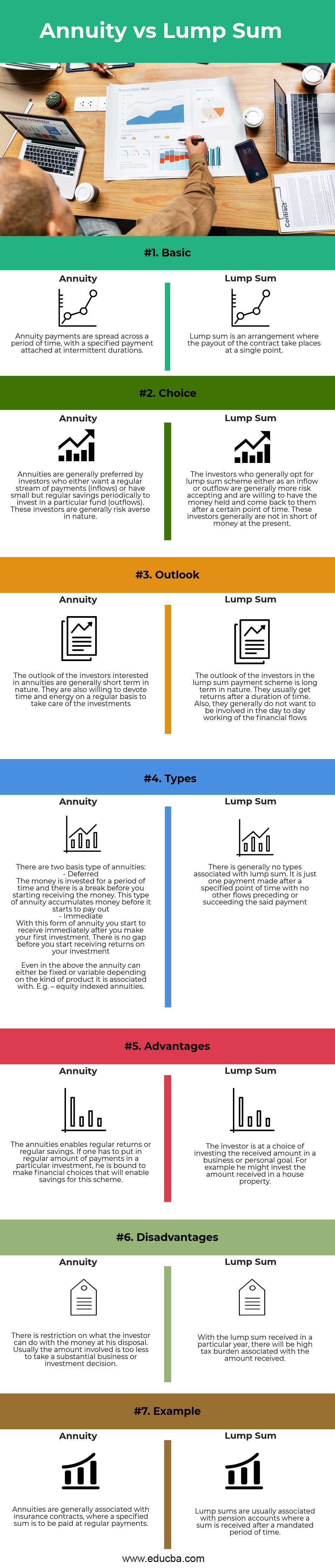

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump. Single life annuity.

Annuity Vs Lump Sum Top 7 Useful Differences To Know

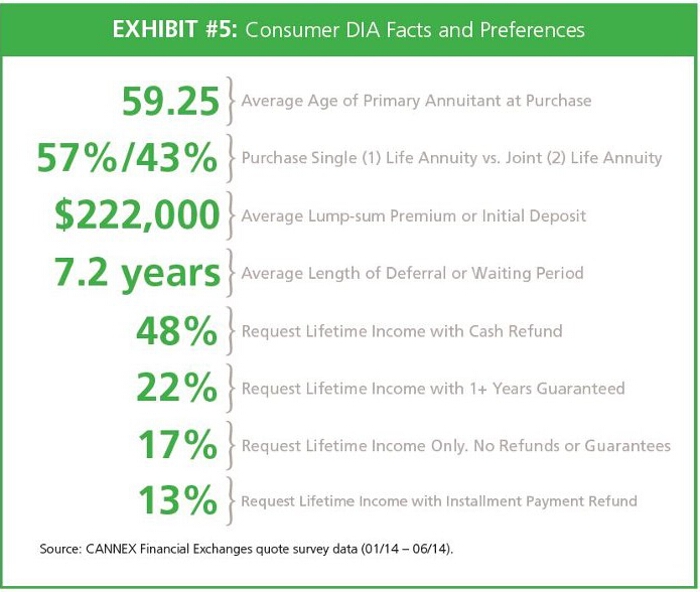

Bonding With Deferred Income Annuities Br Exploring Portfolio Sustainability Options In Retirement Immediateannuities Com

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Pension Annuity Vs Lump Sum Which One Is Best

Cashing Out Your Retirement Plan Lump Sum Or Annuity Sound Mind Investing

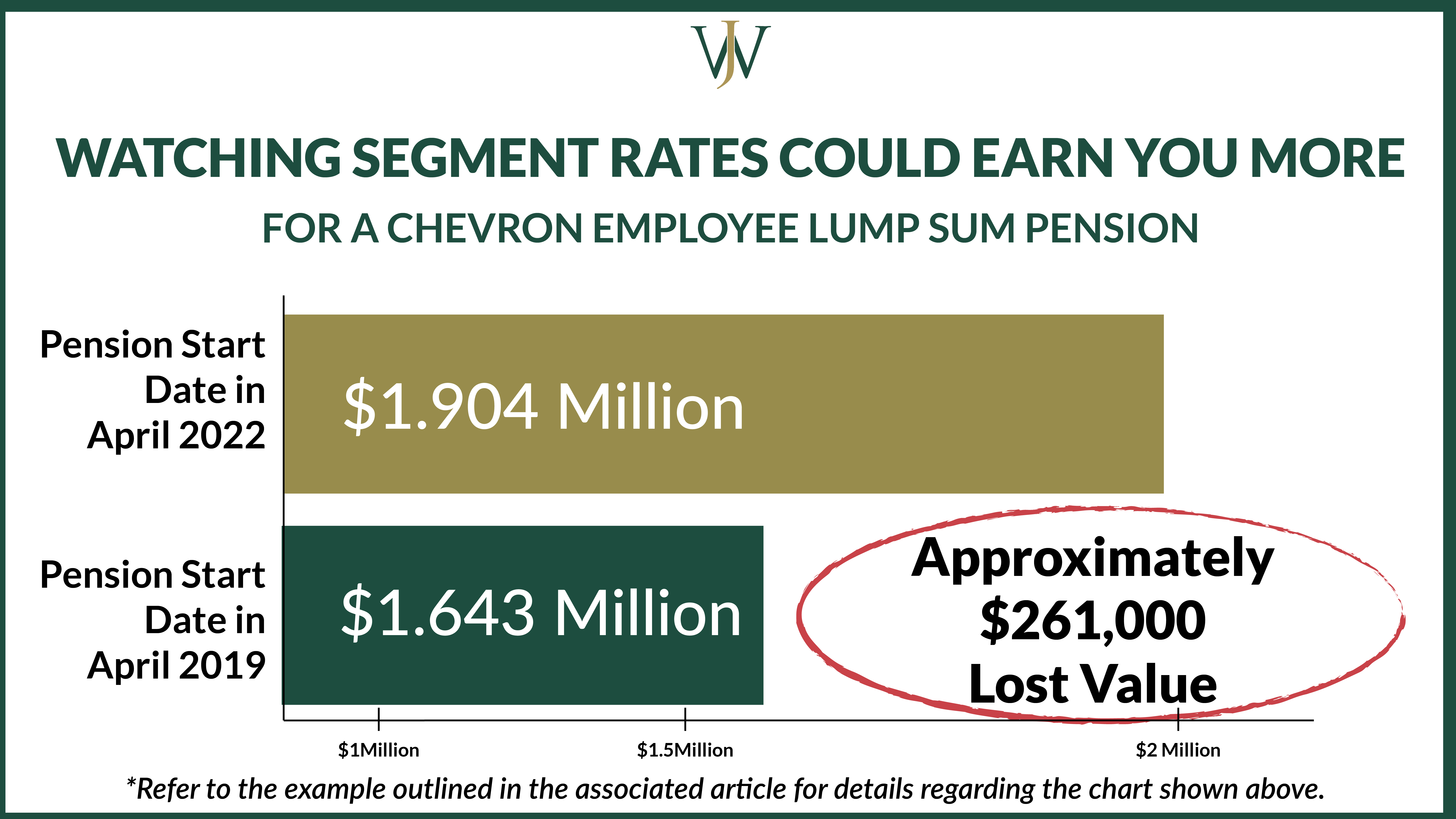

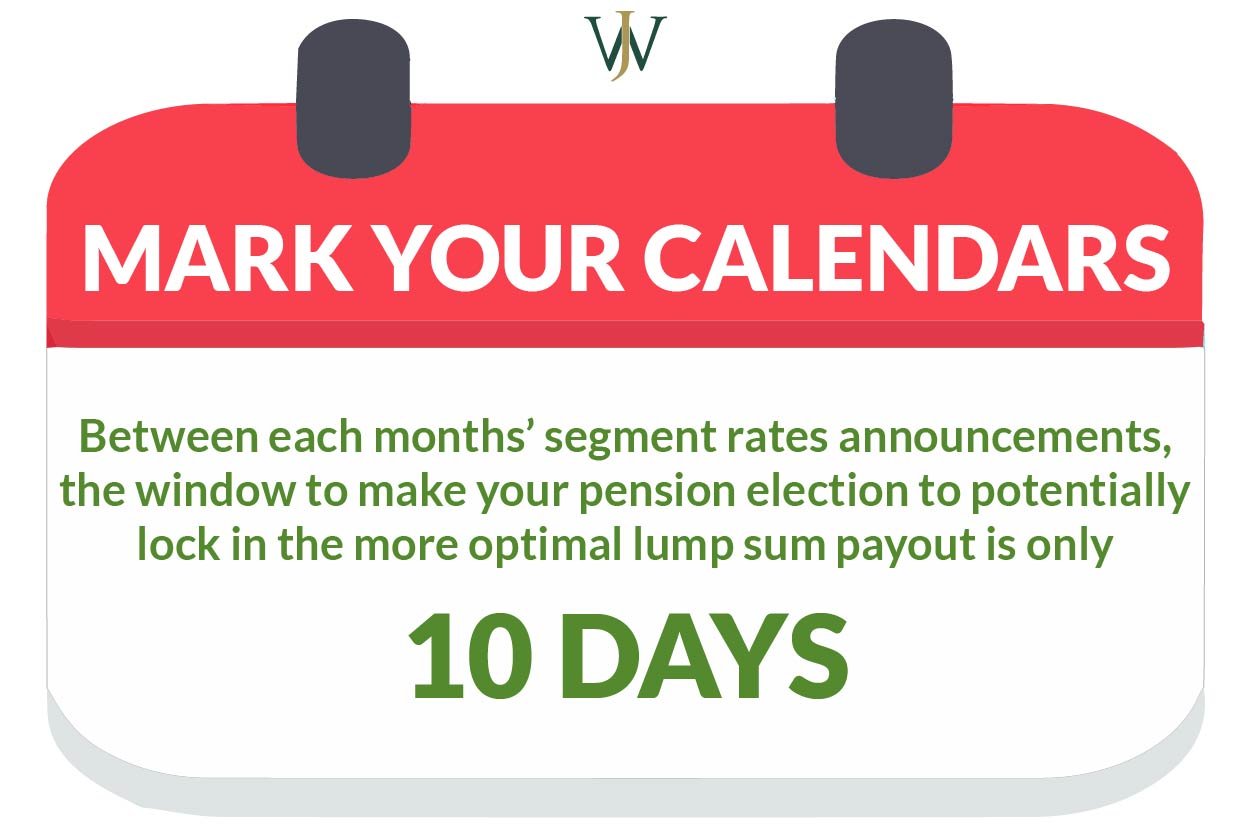

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Lump Sum Structured Settlement Pension Annuity Money Png 564x632px Lump Sum Annuity Area Brand Finance Download

Strategies To Maximize Pension Vs Lump Sum Decisions

The Annuity Vs Lump Sum Why The Annuity Is Better 2022

Difference Between Annuity And Lump Sum Payment Infographics

When Can You Cash Out An Annuity Getting Money From An Annuity

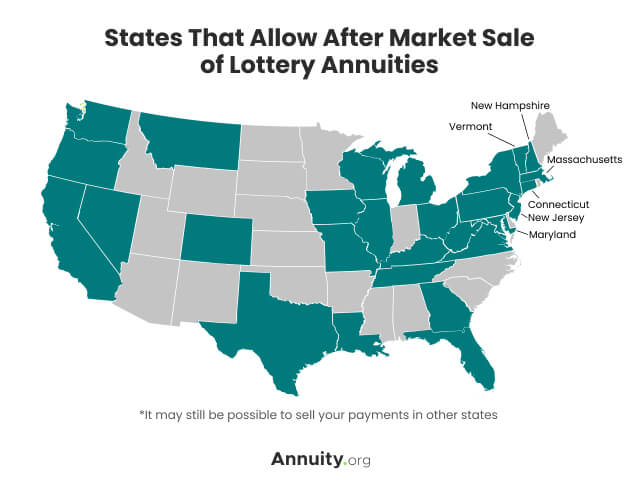

Lottery Payout Options Annuity Vs Lump Sum

Annuity Payout Options Immediate Vs Deferred Annuities

Which Is Better A Lump Sum Pension Payout Or Monthly Payments Marshall Financial Group

Monthly Annuity Or Lump Sum Due

Election Options For The Bp Pension Retirement Accumulation Plan Rap

Lottery Payout Options Annuity Vs Lump Sum